Why is Insurance Annotation Important?

AI models in insurance depend on accurately annotated data to:

- Automate claim verification and document classification.

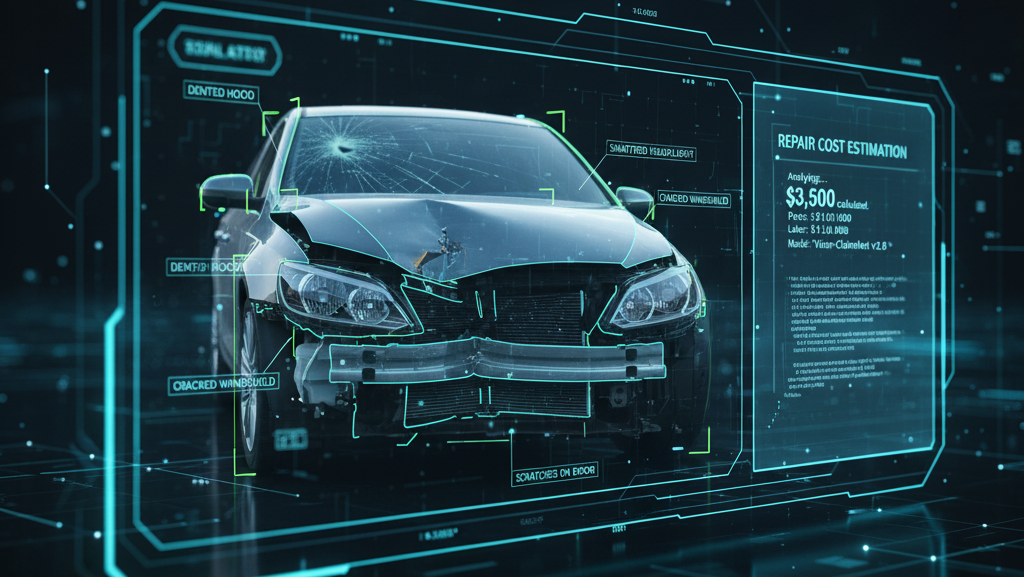

- Assess property or vehicle damage from images or videos.

- Detect fraudulent claims or inconsistencies in documents.

- Improve customer service through chatbots and sentiment analysis.

- Streamline underwriting and policy management workflows.

High-quality annotations ensure AI systems can interpret complex claim data, visual evidence, and legal documents with accuracy—reducing human error and turnaround time while improving transparency and trust.

Types of Insurance Annotation

Image and Video Annotation

Bounding boxes and polygons mark damaged vehicle parts or property areas for claim verification. Semantic segmentation highlights affected regions (e.g., broken glass, dents, fire damage). Frame-by-frame video annotation is used for analyzing accident footage or surveillance data in fraud detection.

Text Annotation

Document and text annotation helps AI read and interpret claim forms, policy documents, and customer communications. Named Entity Recognition (NER) identifies entities like names, policy numbers, and claim IDs. Sentiment and intent analysis categorize customer feedback, while text classification helps sort claim types or detect anomalies in policy data.

Audio Annotation

Call recordings from customer support or claim reporting are annotated for speaker identification, intent, and emotion detection. This helps improve service quality, identify fraudulent intent, and enhance virtual assistant accuracy.